Business confidence slides in Germany

15 10月 2014Business confidence slides in Germany

Balance swings in the eurozone.

New research shows that the economic balance of the eurozone is undergoing significant change as German business confidence took a sharp nosedive in the last quarter, threatening to drag the world’s biggest trading block downwards. According to Grant Thornton’s International Business Report (IBR) [ 737 kb ], the changes uncover a eurozone ‘see-saw effect’, with prospects for growth rising in the economies of Spain, Ireland and Greece just as Germany’s and France’s fall – posing fundamental questions about whether the eurozone can accommodate the varying fortunes and trajectories of its members.

The IBR, a global quarterly survey, reveals that in the last three months optimism across the eurozone fell from net 35% to just 5%. The overall proportion of firms citing shortage of orders as a growth constraint has also risen, and expectations for increased employment are down from 17% to just 6%.

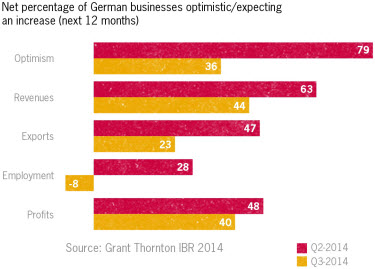

At the same time business optimism in Germany has plummeted from net 79% to just net 36%. This follows a contraction in the German economy in Q2, amid fears of the impact of the Ukraine crisis on trade and the energy supply. The proportion of firms citing a lack of demand as a constraint on growth has jumped from just 6% to almost one in four. Expectations for employment have also dropped into negative territory for the first time since 2010 – the lowest of all 34 economies surveyed. A continued slide in optimism in France, the bloc’s second biggest economy, is also contributing to the eurozone malaise.

At the same time business optimism in Germany has plummeted from net 79% to just net 36%. This follows a contraction in the German economy in Q2, amid fears of the impact of the Ukraine crisis on trade and the energy supply. The proportion of firms citing a lack of demand as a constraint on growth has jumped from just 6% to almost one in four. Expectations for employment have also dropped into negative territory for the first time since 2010 – the lowest of all 34 economies surveyed. A continued slide in optimism in France, the bloc’s second biggest economy, is also contributing to the eurozone malaise.

Francesca Lagerberg, global leader for tax services at Grant Thornton, commented:

“We knew that the economic environment in Germany had worsened, but the severity of the change in outlook is clearly a concern for businesses. It is facing triple trouble in the shape of falling business confidence, shrinking order books and a weak outlook on jobs. This will have a knock-on effect across the rest of the eurozone.

“Policymakers need to address this as a matter of urgency. Germany has a sizeable fiscal surplus which allows it some room for manoeuvre, and could invest in infrastructure to stimulate growth, as recently suggested by the IMF. The ECB has committed to boosting liquidity across the eurozone financial system by kickstarting a round of asset purchasing this month, in response to weak economic growth and business investment, but it could be too little too late. The euro region has shied away from full-blown UK or US-style quantitative easing until now, but tough times may call for bolder measures.

“An extra layer of complexity in the riddle for Europe’s leaders is that measures to ease the pain for businesses need to ensure they don’t extinguish positive signs coming from other parts of the region like Spain, Greece and Ireland. It’s akin to a see-saw effect, whereby both sets of economies seem to struggle to prosper simultaneously. This poses a significant question for the future of the eurozone: can the region really accommodate them all successfully?”

According to the IBR, the outlook in some of the eurozone countries who suffered the most during the crisis is now actually improving. Business expectations for increased revenue in the next 12 months are up in Greece (50% to 70%) and Ireland (58% to 70%) while a growing number of firms in Greece, Ireland and Spain also expect higher profits. Greek and Spanish businesses are also much more bullish about employment over the coming months, a welcome change despite overall unemployment levels remaining high.

Francesca Lagerberg added:

“In the aftermath of the global financial crash Germany was something of a rock to which the eurozone’s economic recovery was anchored while peripheral European economies suffered. The irony is that now, we’re seeing signs of recovery in many of those countries while Germany and France falter.

“These imbalances expose the flaws in the eurozone project. They demonstrate just how difficult it is to find policies that work for a group of economies on different economic trajectories.”

– ends –

For the full results, please go to our data visualisation tool.

Dominic King, Editor, global research, +44 (0)207 391 9537