Do major sporting events benefit economies?

2012年7月26日星期四Do major sporting events benefit economies?

Do major sporting events benefit economies?

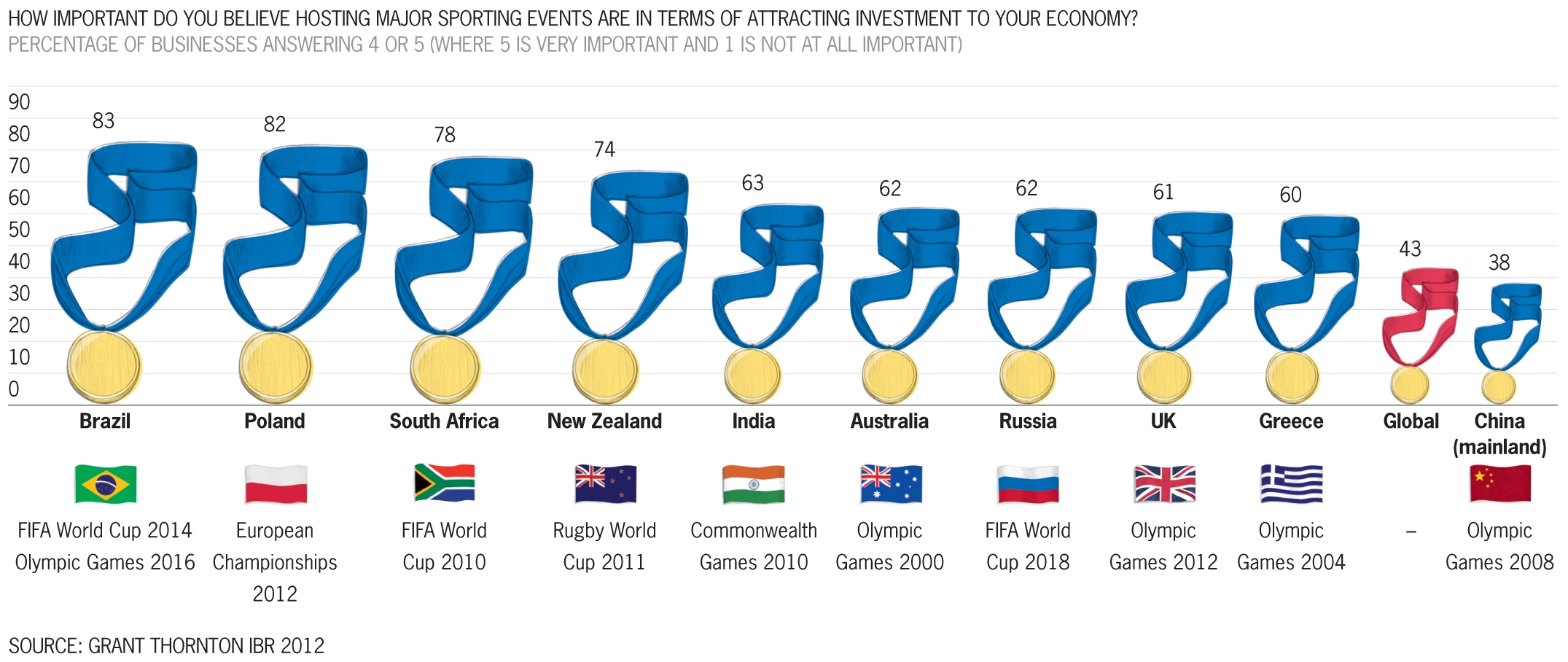

Businesses in emerging markets most value the ability of big sporting events to attract investment to their economies, whilst counterparts in developed economies view them as less important, according to new research from the Grant Thornton International Business Report (IBR). As a result, developed economies must work hard to maximise the economic opportunity these events present and win support from businesses.

With the 2012 Olympic Games opening ceremony tomorrow, the IBR reveals the extent to which developing economies place greater importance on major sporting events in attracting inward investment. In Latin America, almost three quarters (74%) of business leaders believe major sporting events are important in attracting investment to their economy and across the BRIC nations over half (54%) hold this view. By contrast, far fewer businesses in the EU (42%) and North America (44%) believe in the ability of big sporting events to attract investment, dropping to just over one in three (36%) in the G7.

Stephen Gifford, Chief Economist at Grant Thornton UK, said: It is well known that a home advantage can improve the medal haul from major sporting competitions but the IBR research shows that it can also bring in additional investment. Holding a major sporting event gives an emerging economy a global shop window, allowing it to present and market what it has to offer to a massive worldwide audience. For more established economies, international sporting competitions are still a great opportunity, but appear to be just one element of a much bigger offensive to attract investment.

It's also more often the case that developed economies will have the venues, transport and technology infrastructure already in place for any major event. Capital investment to build new infrastructure is therefore much more limited in these economies, compared with the level of investment required in emerging markets such as China and Brazil.

However, with less than a week to go until the start of the 2012 Olympic Games in London, businesses in the UK are far more enthusiastic than their G7 counterparts 61% say big sporting events are important for attracting investment. Indeed, the UK government anticipates that the London Olympics will bring £13bn of economic benefits over the next four years £6bn in the form of foreign direct investment.

Stephen Gifford added: “A big part of winning the race to host big international sporting events is convincing the public and businesses that the benefits will outweigh the obvious costs. Our research suggests that developed economies have to work a lot harder than emerging economies to make a convincing case.

The huge amount of work the Olympic family have done to set out the regeneration benefits and legacy impact of the London Olympic Games is evidence of the hurdles developed economies face in this regard. However, when you compare the result of the UK to its peers, you have to conclude that the message has got through to businesses.

The research also indicates that business leaders in those economies which have recently held, or are soon to hold, major sporting events are more bullish about the investment they bring (the exception is China, where the legacy of the 2008 Olympic Games in Beijing remains unclear). Business leaders in Brazil “which is gearing up to host the 2014 FIFA World Cup and 2016 Olympic Games “show the greatest faith in sports ability to deliver investment (83%). Business leaders in Poland (82%) “host of this years European Championships “and South Africa (78%) “FIFA World Cup 2010 are also positive in this regard.

Notes to editors

The Grant Thornton International Business Report (IBR) provides insight into the views and expectations of over 12,000 businesses per year across 40 economies. This unique survey draws upon 20 years of trend data for most European participants and 10 years for many non-European economies.

Data collection

Data collection is managed by Grant Thornton International's core research partner -Experian. Questionnaires are translated into local languages with each participating country having the option to ask a small number of country specific questions in addition to the core questionnaire. Fieldwork is undertaken on a quarterly basis. The research is carried out primarily by telephone.

Sample

IBR is a survey of both listed and privately held businesses. The data for this release are drawn from interviews with 3,000 businesses from all industry sectors across the globe conducted in May/June 2012. The target respondents are chief executive officers, managing directors, chairmen or other senior executives.

Director of Public Relations and External Affairs

T +1 312 602 8955