New research from Grant Thornton’s International Business Report (IBR) [ 725 kb ] reveals that businesses in developed markets look set to drive global business growth prospects in 2014, while peers in the BRIC economies face a more challenging period. Business optimism and growth indicators have increased substantially in the G7 over the past 12 months, with numbers in many emerging markets falling away, suggesting a rebalancing in the global economy.

New research from Grant Thornton’s International Business Report (IBR) [ 725 kb ] reveals that businesses in developed markets look set to drive global business growth prospects in 2014, while peers in the BRIC economies face a more challenging period. Business optimism and growth indicators have increased substantially in the G7 over the past 12 months, with numbers in many emerging markets falling away, suggesting a rebalancing in the global economy.

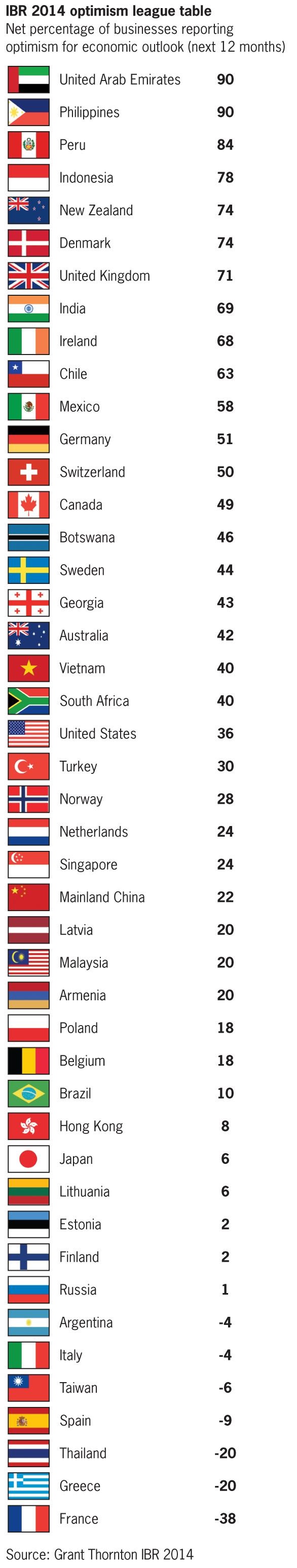

This time last year, business optimism in the G7 economies stood at net -16% compared to 39% in the BRIC economies. However the picture heading into 2014 is markedly different with optimism in the G7 rising to 28%, driven by improvements in Japan, the UK and US, an increase of 44 percentage points. Optimism in the BRICs has fallen by 17 percentage points to 22% with Brazil hitting an all-time low (10%) and Russia its lowest level since 2009 (1%).

Ed Nusbaum, global CEO at Grant Thornton, said: “We’re braced for a momentum shift in the global business dynamic as we enter 2014. The BRICs have largely driven global growth since the financial crisis but the G7 economies are making a comeback – things even seem to be improving in the eurozone. The contrast from 12 months ago is stark – as business leaders plan for 2014, growth prospects in the G7 look more robust but uncertainty is growing in the BRICs and across Latin America."

This change in levels of business confidence feeds directly into business growth prospects. Revenue prospects across the G7 have risen by 18 percentage points over the past 12 months to 49%. In the BRICs though, expectations for revenue growth have fallen by 27 percentage points to 54% over the same period. Similarly, expectations for raising profits across the G7 were up 16 percentage points to 36% in Q4-2013 compared with 12 months previously while BRIC peers' expectations dropped 28 percentage points to 47% over the same period.

Expectations for employment, investment and salaries have also risen in the G7 since this time last year while those of BRIC peers have declined. Moreover, 12 months ago, 39% of business leaders in both the G7 and BRIC economies cited a lack of demand as a constraint on growth. This fell to 29% in Q4-2013 in the G7 but rose slightly to 40% in the BRICs.

Ed Nusbaum added: “Twelve months ago, growth prospects in the G7 economies looked markedly different: Europe was in recession, the US was teetering over the fiscal cliff and Abenomics had yet to boost Japan. More recently we have seen growth return to these economies as unemployment falls and consumer spending rises. Consequently businesses are seeing renewed demand for their goods and services which translates into improved short and long-term growth prospects.

“The situation in the BRIC economies is more difficult. The prospect of the US Federal Reserve tapering its extensive quantitative easing programme sent emerging markets into a spin in 2013 and the signs are that this will finally happen at some point in 2014. Growth has slowed markedly in all four BRIC economies and while the outlook for China remains more stable, Brazil, India and Russia face serious economic and political challenges over the next 12 months.

“The hope is that we are moving toward a more balanced global economy with fewer extremes. This should support business growth prospects; greater balance and less volatility means businesses can plan for the future and make decisions with greater certainty."

- ends -

John Vita, Director, public relations and external affairs, +1 312 602 8955

Dominic King, Editor, global research, +44 (0)20 7391 9537