-

國內財務簽證及PCAOB財務簽證

真正讓我們與眾不同的是我們服務客戶的經驗,讓正大所能夠在客戶服務上面創造更多的價值

-

稅務簽證

國稅局對於優質會計師事務所出具之報告作書面審核,公司被選案查核機率較低

-

營業稅簽證

本所採用Grant Thornton Voyager 軟體及其他軟體工具等,來提升工作效率

-

公開發行及上市櫃專案輔導與規劃

本所特將會計師與經理群之菁英分成八大部,組成團隊並提供最迅速而完善之專業服務

-

IFRS專區

分享Grant Thornton International之國際財務報導準則專業服務團隊及成員所內專家之寶貴經驗

-

移轉訂價服務

『移轉訂價』是一個全球性的租稅議題。隨著跨國商業活動高速的成長,各國稅局開始注意到稅基是否有在關係人交易中不當的流失,故企業的移轉訂價安排成為關鍵。

-

跨國交易租稅規劃

正大是全球知名會計師聯盟組織Grant Thornton會員,目前約一半的客戶是跨國企業,也因此國際公司在台灣所會遇到的稅務問題,正大所的團隊都已經處理過很多次了。

-

外國專業投資機構之稅務代理人(FINI/FIDI)

外國專業投資機構之稅務代理人(FINI/FIDI)

-

所得稅法第4條,第8條及第25條等專案申請

所得稅法第4條,第8條及第25條等專案申請

-

租稅協定之專案申請

租稅協定之專案申請

-

租稅獎勵申請

租稅獎勵申請

-

稅負平衡政策訂定與假定稅計算

稅負平衡政策訂定與假定稅計算

-

代為計算薪資及各項扣繳

代為計算薪資及各項扣繳

-

資遣通報

資遣通報

-

處理薪資轉帳事宜及繳納扣繳稅款

處理薪資轉帳事宜及繳納扣繳稅款

-

勞保賠償給付申請

勞保賠償給付申請

-

勞健保,二代健保及退休金之申報及繳納

勞健保,二代健保及退休金之申報及繳納

-

年底開立扣繳憑單

年底開立扣繳憑單

-

IT 顧問服務

IT 顧問服務

-

PRIMA 顧問服務

PRIMA 顧問服務

-

營運計劃書編制

營運計劃書編制

-

績效考核服務

正大聯合會計師事務所協助企業進行績效制度建立及優化,創造勞資雙贏的局面。

-

沙賓氏法案第404條遵循查核

沙賓氏法案第404條遵循查核

-

內部稽核服務

內部稽核服務

-

協議程序(併購交易實地查核)

協議程序(併購交易實地查核)

-

風險管理服務

協議程序(併購交易實地查核)

-

舞弊調查服務

舞弊調查服務

-

電腦鑑識服務

電腦鑑識服務

-

外籍人士工作證申請

外籍人士工作證申請

-

商業文件英日文翻譯服務

商業文件英日文翻譯服務

-

公司、分公司、行號設立登記

公司、分公司、行號設立登記

-

外商分公司、辦事處設立登記

外商分公司、辦事處設立登記

-

陸資來台投資設立登記

陸資來台投資設立登記

-

行政救濟

行政救濟

-

企業法律諮詢

企業法律諮詢

-

破產與限制

破產與限制

-

公司解散和清算

公司解散和清算

-

供應商和員工背景調查

供應商和員工背景調查

-

存證信函草稿服務

存證信函草稿服務

-

中英文協議的準備和審查

中英文協議的準備和審查

-

放寬限制出境

放寬限制出境

-

勞動法合規與勞資談判

勞動法合規與勞資談判

-

企業和個人資產規劃

企業和個人資產規劃

-

企業評價服務

Grant Thornton Taiwan的評價團隊提供的評價領域涵蓋企業股權、無形資產、合夥權益、專案計畫等。專業的評價服務得以協助客戶完成合併、收購及出售資產、稅務規劃及法令遵循、財務報導等。

-

ESG 確信報告及相關顧問業務

正大聯合會計師事務所取得了金管會授權辦理 ESG 確信業務(永續報告及溫室氣體)。 目前已經協助許多企業辦理ESG相關業務,如需更多相關資訊,歡迎與我們ESG負責的會計師聯絡。

-

網際網路購物包裝減量會計師確信報告服務

「公司之資本額、實收資本額或中華民國境內營運資金」達1.5億元以上,或自有到店取貨據點數達500以上之網際網路零售業,在包裝減量方面在包裝減量方面,應依平均包裝材減重率或循環箱(袋)使用率規定擇一辦理,且其減量成果須於每年3月31日前經會計師出具確信報告。關於會計師確信報告服務,歡迎跟我們聯絡。

-

其他政府委託專案查核

其他政府委託專案查核

-

財團法人及社團法人等非營利組織(公益慈善基金會)

財團法人及社團法人等非營利組織(公益慈善基金會)

-

文化教育相關產業(私立學校)

文化教育相關產業(私立學校)

Region divided between outward-looking Pacific economies and inward-looking counterparts on Atlantic side

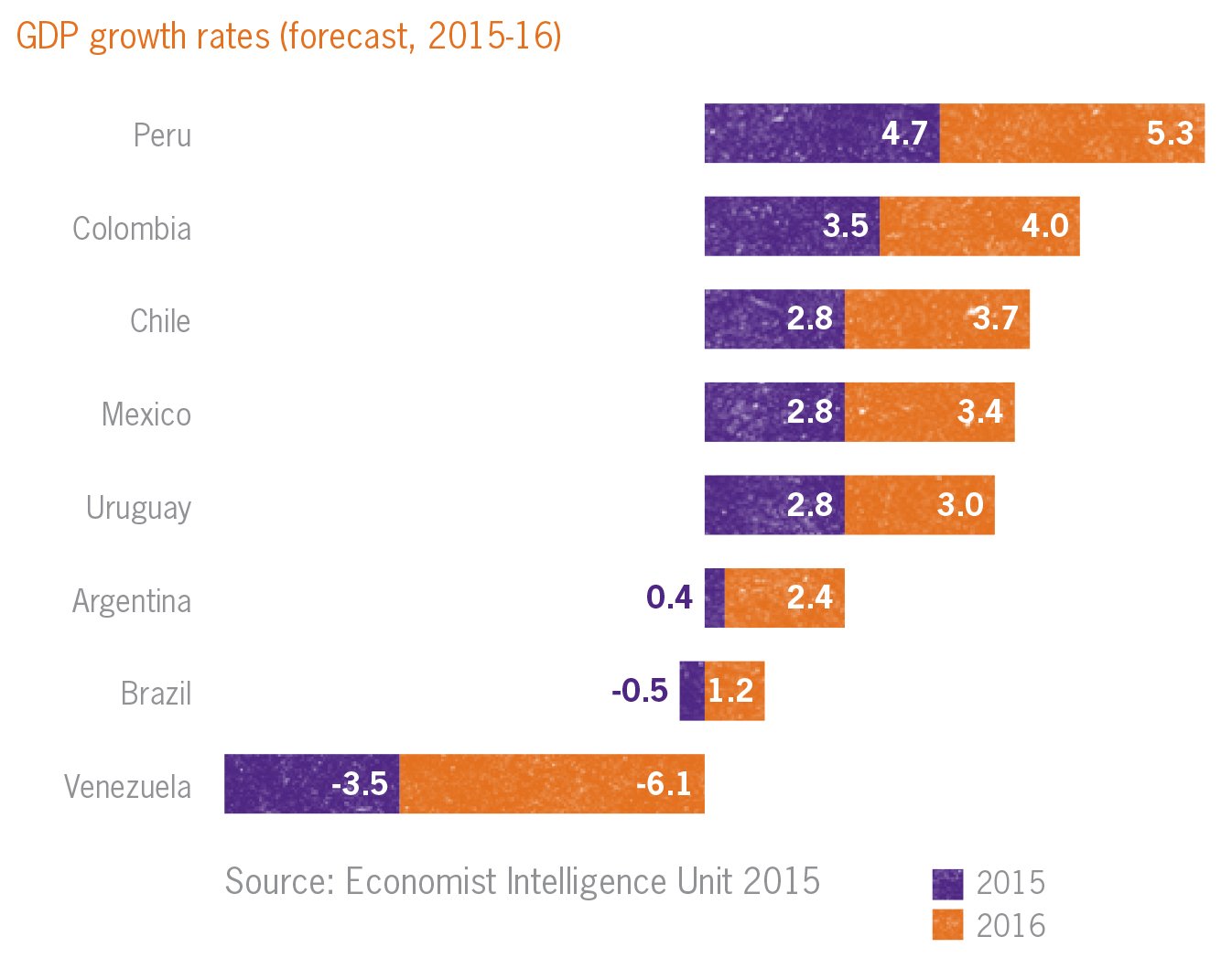

The end of the commodity supercycle has had a profound effect on Latin America. For a decade or more, regional economies grew principally by selling their primary commodities to China and other rapidly developing markets in Asia. The financial crisis saw economies across Latin America stall – and even contract sharply in the case of Mexico due to its close economic ties with the United States – but the recovery was swift with the region posting some of the fastest growth rates in the world. In 2010, Brazil grew by 7.5% in 2010, Peru and Uruguay by 8.4% and Argentina by 9.1%.

However 2010 proved to be something of a highpoint for the region with developments since markedly less encouraging, especially in the more inward-looking Atlantic economies, such as Argentina, Brazil and Venezuela. In 2014, Argentina, which defaulted on a sovereign debt repayment and remains gripped by political protest and investment inertia ahead of the elections later this year, contracted by an estimated 1.7%. Venezuela, where the fall in the oil price has cut a gaping hole in the government budget even as businesses and consumers struggle with exchange and price controls, fared even worse, shrinking by an estimated 3.0%.

Brazil, which accounts for around 40% of regional output also had a tough 2014. Despite hosting a relatively successful FIFA World Cup (off the pitch, at least) the economy grew by just 0.3% in 2014 and while Dilma Rousseff was re-elected, she gained only 51.6% of the vote, the tightest victory in electoral history, and lost heavily in the most productive states such as Sao Paulo. If each Brazilian state was weighted by GDP (as opposed to population), her challenger, Aécio Neves would have taken 53% of the vote.

Latin America’s Pacific economies fared better in 2014, although they too suffered from the regional slowdown. Mexico has embarked on an ambitious raft of reforms with the aim of opening sectors such as education, energy and telecoms up to further competition. The economy grew by just 2.4% in 2014 but the hope is that the reform programme will raise long-term growth potential. Chile (2.0%) and Peru (3.6%) saw growth slip in 2014 due to the slide in global copper and gold prices driven by slowing demand from China. Growth rates in Colombia (4.8%) continue to impress and government talks with the FARC guerrilla group appear to be progressing well.

Tellingly, the Pacific economies have made greater strides towards embracing globalisation. Not only have Chile, Peru, Colombia, and Mexico formed the Alianza del Pacífico (the Pacific Alliance), a trade bloc that seeks to advance economic integration, free trade and free markets, but they (excluding Colombia) are also involved in ongoing negotiations regarding the Trans Pacific Partnership (TPP). Mexico alone has 11 free trade agreements covering 43 economies.

Dominic King, Editor, global research, +44 (0)207 391 9537