-

國內財務簽證及PCAOB財務簽證

真正讓我們與眾不同的是我們服務客戶的經驗,讓正大所能夠在客戶服務上面創造更多的價值

-

稅務簽證

國稅局對於優質會計師事務所出具之報告作書面審核,公司被選案查核機率較低

-

營業稅簽證

本所採用Grant Thornton Voyager 軟體及其他軟體工具等,來提升工作效率

-

公開發行及上市櫃專案輔導與規劃

本所特將會計師與經理群之菁英分成八大部,組成團隊並提供最迅速而完善之專業服務

-

IFRS專區

分享Grant Thornton International之國際財務報導準則專業服務團隊及成員所內專家之寶貴經驗

-

移轉訂價服務

『移轉訂價』是一個全球性的租稅議題。隨著跨國商業活動高速的成長,各國稅局開始注意到稅基是否有在關係人交易中不當的流失,故企業的移轉訂價安排成為關鍵。

-

跨國交易租稅規劃

正大是全球知名會計師聯盟組織Grant Thornton會員,目前約一半的客戶是跨國企業,也因此國際公司在台灣所會遇到的稅務問題,正大所的團隊都已經處理過很多次了。

-

外國專業投資機構之稅務代理人(FINI/FIDI)

外國專業投資機構之稅務代理人(FINI/FIDI)

-

所得稅法第4條,第8條及第25條等專案申請

所得稅法第4條,第8條及第25條等專案申請

-

租稅協定之專案申請

租稅協定之專案申請

-

租稅獎勵申請

租稅獎勵申請

-

稅負平衡政策訂定與假定稅計算

稅負平衡政策訂定與假定稅計算

-

代為計算薪資及各項扣繳

代為計算薪資及各項扣繳

-

資遣通報

資遣通報

-

處理薪資轉帳事宜及繳納扣繳稅款

處理薪資轉帳事宜及繳納扣繳稅款

-

勞保賠償給付申請

勞保賠償給付申請

-

勞健保,二代健保及退休金之申報及繳納

勞健保,二代健保及退休金之申報及繳納

-

年底開立扣繳憑單

年底開立扣繳憑單

-

IT 顧問服務

IT 顧問服務

-

PRIMA 顧問服務

PRIMA 顧問服務

-

營運計劃書編制

營運計劃書編制

-

績效考核服務

正大聯合會計師事務所協助企業進行績效制度建立及優化,創造勞資雙贏的局面。

-

沙賓氏法案第404條遵循查核

沙賓氏法案第404條遵循查核

-

內部稽核服務

內部稽核服務

-

協議程序(併購交易實地查核)

協議程序(併購交易實地查核)

-

風險管理服務

協議程序(併購交易實地查核)

-

舞弊調查服務

舞弊調查服務

-

電腦鑑識服務

電腦鑑識服務

-

外籍人士工作證申請

外籍人士工作證申請

-

商業文件英日文翻譯服務

商業文件英日文翻譯服務

-

公司、分公司、行號設立登記

公司、分公司、行號設立登記

-

外商分公司、辦事處設立登記

外商分公司、辦事處設立登記

-

陸資來台投資設立登記

陸資來台投資設立登記

-

行政救濟

行政救濟

-

企業法律諮詢

企業法律諮詢

-

破產與限制

破產與限制

-

公司解散和清算

公司解散和清算

-

供應商和員工背景調查

供應商和員工背景調查

-

存證信函草稿服務

存證信函草稿服務

-

中英文協議的準備和審查

中英文協議的準備和審查

-

放寬限制出境

放寬限制出境

-

勞動法合規與勞資談判

勞動法合規與勞資談判

-

企業和個人資產規劃

企業和個人資產規劃

-

企業評價服務

Grant Thornton Taiwan的評價團隊提供的評價領域涵蓋企業股權、無形資產、合夥權益、專案計畫等。專業的評價服務得以協助客戶完成合併、收購及出售資產、稅務規劃及法令遵循、財務報導等。

-

ESG 確信報告及相關顧問業務

正大聯合會計師事務所取得了金管會授權辦理 ESG 確信業務(永續報告及溫室氣體)。 目前已經協助許多企業辦理ESG相關業務,如需更多相關資訊,歡迎與我們ESG負責的會計師聯絡。

-

網際網路購物包裝減量會計師確信報告服務

「公司之資本額、實收資本額或中華民國境內營運資金」達1.5億元以上,或自有到店取貨據點數達500以上之網際網路零售業,在包裝減量方面在包裝減量方面,應依平均包裝材減重率或循環箱(袋)使用率規定擇一辦理,且其減量成果須於每年3月31日前經會計師出具確信報告。關於會計師確信報告服務,歡迎跟我們聯絡。

-

其他政府委託專案查核

其他政府委託專案查核

-

財團法人及社團法人等非營利組織(公益慈善基金會)

財團法人及社團法人等非營利組織(公益慈善基金會)

-

文化教育相關產業(私立學校)

文化教育相關產業(私立學校)

Worries about a Brexit overtake Grexit concerns – but both still bad for business stability

Businesses across Europe have greater concern about the prospect of the UK leaving the EU than Greece leaving the eurozone, according to new research from Grant Thornton. This comes just as the UK is about to go the polls in an election where a potential EU referendum is a major policy battleground, and just ahead of Greece’s deadline to repay almost €1billion to the International Monetary Fund in May. This continued uncertainty over both countries’ positions could have a destabilising effect on the European economy, just as it begins to show signs of turning a corner.

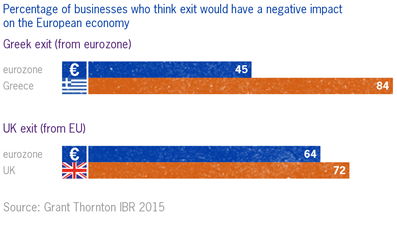

Grant Thornton’s research, compiled for its upcoming Future of Europe report, found that nearly two thirds of businesses (64%) in the eurozone believe a British exit from the EU would have a negative impact on Europe. This compares to 45% of businesses who believe a Greek exit from the eurozone would be negative. The difference is even more pronounced among non-euro EU members, at 72% and 46% respectively.

The research also shows that levels of concern are considerably higher in the UK and Greece themselves. In the UK, 72% of firms think a British exit would have a negative impact on the EU, while 84% of Greek businesses believe a Grexit would be negative.

Sacha Romanovitch, CEO Elect at Grant Thornton UK LLP, commented: “Relations between Brussels and London may not always be comfortable, but there’s absolutely no doubt that Europe’s business community values the UK’s membership extremely highly. The General Election in Britain could mark a real crossroads though, as depending on the outcome, it could be seeing an in/out referendum on Europe in its next term. From our conversations with dynamic mid-sized businesses throughout the UK, we know the uncertainty created by a potential referendum is a real and worrying concern. With opinion polls suggesting a vote to leave is a distinct possibility, and given London’s status as Europe’s financial centre, it’s easy to understand why European businesses are worried.

“On the other hand, this aversion to a Brexit arguably gives the next British government a strong hand when it comes to seeking reform in Europe – and may test President Juncker’s reported refusal to consider any major EU treaty changes. One thing’s for sure; businesses and policymakers across the continent will be watching very closely to see how the dust settles on 8 May.”

Grant Thornton’s research reveals that in Germany, one of the leading architects of the European project, 61% of business leaders believe a Brexit would damage Europe compared to just 37% who feel the same about a Grexit. Concerns are also high in Spain (at 84% for a Brexit and 57% for a Grexit) and Ireland (at 92% for a Brexit and 64% for a Grexit).

Sacha Romanovitch added: “Business fears over the impact of a Grexit may have been overtaken by fears of a Brexit, but it would be dangerous to bury heads in the sand and ignore the possibility that either, or both, scenarios could still happen. New figures show that Greece’s budget surplus has shrunk dramatically since the new anti-austerity government took power, while its budget deficit grew even larger in 2014.

“Put simply, neither eventuality should be underestimated. With the UK election set to be the most unpredictable in years, and while Greek negotiations with their eurozone counterparts continue, we could be facing a damaging period of uncertainty. The European economy appears to have turned a corner after years in the economic doldrums, so we must hope that policymakers in London, Athens, Brussels and other capitals are focused on maintaining a stable environment for businesses across Europe.”

Read The future of Europe 2015.

– ends –