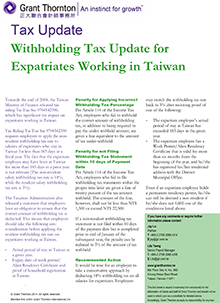

Towards the end of 2008, the Taiwan Ministry of Finance released tax ruling Tai Tsai Sui 9704542390, which has significant tax impact on expatriates working in Taiwan. Tax Ruling Tai Tsai Sui 9704542390 requires employers to apply the nonresident withholding tax rate to salaries of expatriates who stay in Taiwan for less than 183 days in a fiscal year. The fact that the expatriate employee may have been in Taiwan for more than 183 days in a prior year is not relevant (The non-resident salary withholding tax rate is 18%, while the resident salary withholding tax rate is 5%).

Jay Lo,Tax Partner , +886 (0)2 2789 0887 Ext. 314