-

Audit

At Grant Thornton, our IFRS advisers can help you navigate the complexity of financial reporting.

-

IFRS support

Our IFRS advisers can help you navigate the complexity of the Standards so you can focus your time and effort on running your business.

-

Transfer pricing

The laws surrounding transfer pricing are becoming ever more complex, as tax affairs of multinational companies are facing scrutiny from media, regulators and the public

-

Tax Audit

Our trusted teams can prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and legitimate tax benefits.

-

Tax Appeal

Our teams have in-depth knowledge of the relationship between domestic and international tax laws.

-

Advance Ruling

Through our global organisation of member firms, we support both companies and individuals, providing insightful solutions to minimise the tax burden for both parties.

-

Tax Treaty Benefits Application

Tax Treaty Benefits Application

-

FINI/FIDI Tax Services

Our solutions include dealing with emigration and tax mitigation on the income and capital growth of overseas assets.

-

Expatriate Income Tax Filing

Our team has extensive experience in helping expatriates in Taiwan to file personal income returns and claim tax refund where applicable. We file approximately 300 expatriate personal income tax returns in Taiwan annually.

-

Bookkeeping

Effective bookkeeping and financial accounting are essential to the success of forward-thinking organisations. To get the optimum benefit from this part of your business, you'll need an experienced team behind you.

-

Inventory movement reporting

Outsourcing your operations and specific business functions to Grant Thornton can not only cut costs, but also bring new insights and experience to your business.

-

Payroll administration

Payroll and, in addition, personnel administration are the biggest and most time-consuming challenges facing expanding organisations. Grant Thornton’s outsourcing teams can manage these commitments on your behalf, allowing you to focus on what you do best – growing your business.

-

Trust account management

Running a transparent and trusted business means keeping shareholders, owners, management and other important stakeholders informed about key developments in your organisation.

-

VAT returns

At Grant Thornton, we understand the pressures management is under to achieve results, and for this reason we have developed systems for taking away the burden of compliance chores, leaving you to spend your time and energy on the core activities that ultimately lead to growth.

-

Head Office reporting

Businesses frequently outsource some of their daily operating tasks in order to focus their energy on their core competencies, while improving performance and lowering costs of their non-core activities. By saving time and money, Grant Thornton's outsourcing services allow clients to concentrate on what is really important to their business.

-

Executive Search

We understand that HR leaders need to focus on securing talents and this is no easy exercise. Our mission is to share best practices with our clients and help our clients to stay competitive in the market. Please do not hesitate to contact us to find out more about details of our services and how we can work together with you.

-

Work Permit and Employment Gold Card Application Services

Work Permit and Employment Gold Card Application Services

-

Expatriate Tax

Expatriate Tax

-

PRIMA Consulting Services

PRIMA Consulting Services

-

Business Operation Plan Composition

Business Operation Plan Composition

-

Setting up legal entities

With a global network of experts in their respective tax and regulatory environments, Grant Thornton advisors help individuals and corporations establish the type of business entity that will best position them to achieve their goals from the very start of their operations.

-

Liquidation and de-registration

Sometimes a business suffers an adverse event which impacts its ability to continue trading. And sometimes a solvent sale proves unsuccessful or a turnaround just isn't an option.

-

Update company statutory record

With a global network of experts in their respective tax and regulatory environments, Grant Thornton advisors help individuals and corporations establish the type of business entity that will best position them to achieve their goals from the very start of their operations.

-

Merger and Acquisition

Merger and Acquisition

-

Administrative remedies

Administrative remedies

-

Corporate legal consulting

Corporate legal consulting

-

Bankruptcy and restructuring

Bankruptcy and restructuring

-

Company dissolutions and liquidations

Company dissolutions and liquidations

-

Supplier and employee background investigations

Supplier and employee background investigations

-

Legal attest letter drafting service

Legal attest letter drafting service

-

Preparation and review of agreements in Chinese and English

Preparation and review of agreements in Chinese and English

-

Lifting restrictions on going abroad

Lifting restrictions on going abroad

-

Labor law compliance and labor-management negotiation

Labor law compliance and labor-management negotiation

-

Business and personal asset planning

Inheritance, inheritance tax, family business, and personal asset planning

-

Not for profit organizations

Not for profit organizations

-

Schools

Schools

-

Others

Others

Key findings from our quarterly economic update

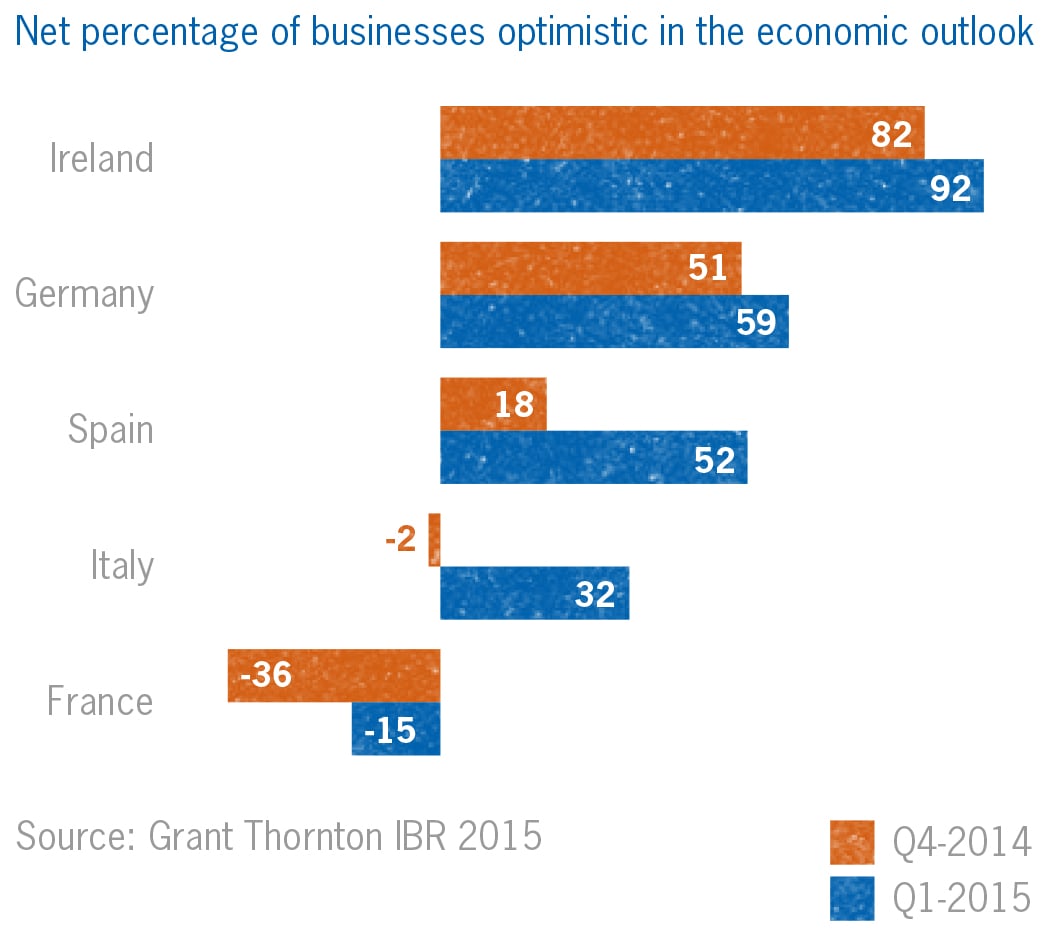

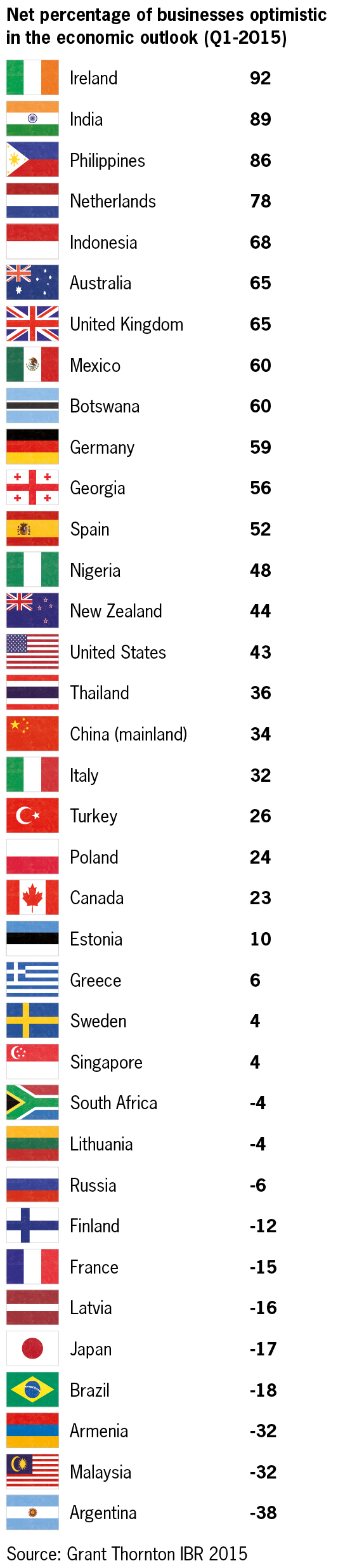

Almost three months on from the launch of the European Central Bank's quantitative easing programme, new research from the Grant Thornton International Business Report (IBR) [ 741 kb ]reveals a jump in business optimism in the eurozone in the first quarter of 2015, with confidence moving back up towards pre-crisis levels. Many of the economies hardest hit by the financial crisis, such as Ireland and Spain, are increasingly optimistic about their growth prospects although the global picture is mixed, with Latin America falling to an all-time low.

The IBR shows that net 34% of business leaders in the eurozone are optimistic in the economic outlook, up from just 13% in Q4-2014 and just 5% in Q3-2014. The resurgence has been driven largely by improvements in Spain (52%), Italy (32%) and Ireland (92%) - with the latter currently the most optimistic business community in the world. German businesses remain bullish (59%) with their French peers (-15%) still overwhelmingly pessimistic, although less so compared with the previous quarter.

Francesca Lagerberg, global leader for tax services at Grant Thornton, commented:

“We’ve seen a few false dawns in the eurozone following the sovereign debt crisis but when you consider how buoyant these figures are in the context of the uncertainty caused by the Greek elections, this could indicate a decisive turning point in the regional economy. Following the lead of the UK and the US, quantitative easing looks to have had the immediate effect that policymakers were hoping for, giving businesses the confidence and support they need to invest in the growth of their operations.

“Germany continues to drive the currency bloc, but it is heartening to see the amazing transformation in countries such as Ireland, Italy and Spain. Major austerity drives have caused severe discomfort for businesses and consumers but there is now a growing feeling of light at the end of the tunnel. With an improving real estate sector in Spain, higher exports and investment spending in Ireland and the anti-corruption drive in Italy, it is no surprise that businesses are increasingly optimistic about growth prospects.”

Expectations for increasing revenues and profits are high in each of these three economies. In Spain, 59% of businesses expect to increase revenues over the next 12 months, and 50% expect profits to go the same way. Ireland is even more buoyant with 70% positive on revenues and 66% on profits. Italian businesses are slightly less bullish but have posted double digit climbs in both indicators over the past three months.

Francesca Lagerberg added:

“European firms will take heart from this transformation and we expect businesses to invest more in people, research and development and facilities as uncertainty subsides. However there is one cloud on the horizon: the prospect of a Greek exit from the eurozone. The region is probably better insulated than it was three years ago but business leaders will be watching the situation very closely indeed.”

Global outlook

Globally, the increase in optimism in Europe is mitigated by sharp downturns in Latin America and Eastern Europe. Driven by Brazil (-18%), Latin America has fallen to an all-time low of 5%. Business confidence in Eastern Europe has dropped to just 6% with Russian businesses increasingly pessimistic (-6%).

Francesca Lagerberg concluded:

“Brazil is suffering from the major corruption scandal surrounding Petrobras which is threatening to topple the government, while economic sanctions are having a severe impact on the Russian economy. By contrast, China and India are moving strongly ahead. The BRICs are certainly no longer moving in lockstep.”

To learn more, explore the full quarterly results via our data visualisation tool or view the Q1 optimism infographic.