-

Audit

At Grant Thornton, our IFRS advisers can help you navigate the complexity of financial reporting.

-

IFRS support

Our IFRS advisers can help you navigate the complexity of the Standards so you can focus your time and effort on running your business.

-

Transfer pricing

The laws surrounding transfer pricing are becoming ever more complex, as tax affairs of multinational companies are facing scrutiny from media, regulators and the public

-

Tax Audit

Our trusted teams can prepare corporate tax files and ruling requests, support you with deferrals, accounting procedures and legitimate tax benefits.

-

Tax Appeal

Our teams have in-depth knowledge of the relationship between domestic and international tax laws.

-

Advance Ruling

Through our global organisation of member firms, we support both companies and individuals, providing insightful solutions to minimise the tax burden for both parties.

-

Tax Treaty Benefits Application

Tax Treaty Benefits Application

-

FINI/FIDI Tax Services

Our solutions include dealing with emigration and tax mitigation on the income and capital growth of overseas assets.

-

Expatriate Income Tax Filing

Our team has extensive experience in helping expatriates in Taiwan to file personal income returns and claim tax refund where applicable. We file approximately 300 expatriate personal income tax returns in Taiwan annually.

-

Bookkeeping

Effective bookkeeping and financial accounting are essential to the success of forward-thinking organisations. To get the optimum benefit from this part of your business, you'll need an experienced team behind you.

-

Inventory movement reporting

Outsourcing your operations and specific business functions to Grant Thornton can not only cut costs, but also bring new insights and experience to your business.

-

Payroll administration

Payroll and, in addition, personnel administration are the biggest and most time-consuming challenges facing expanding organisations. Grant Thornton’s outsourcing teams can manage these commitments on your behalf, allowing you to focus on what you do best – growing your business.

-

Trust account management

Running a transparent and trusted business means keeping shareholders, owners, management and other important stakeholders informed about key developments in your organisation.

-

VAT returns

At Grant Thornton, we understand the pressures management is under to achieve results, and for this reason we have developed systems for taking away the burden of compliance chores, leaving you to spend your time and energy on the core activities that ultimately lead to growth.

-

Head Office reporting

Businesses frequently outsource some of their daily operating tasks in order to focus their energy on their core competencies, while improving performance and lowering costs of their non-core activities. By saving time and money, Grant Thornton's outsourcing services allow clients to concentrate on what is really important to their business.

-

Executive Search

We understand that HR leaders need to focus on securing talents and this is no easy exercise. Our mission is to share best practices with our clients and help our clients to stay competitive in the market. Please do not hesitate to contact us to find out more about details of our services and how we can work together with you.

-

Work Permit and Employment Gold Card Application Services

Work Permit and Employment Gold Card Application Services

-

Expatriate Tax

Expatriate Tax

-

PRIMA Consulting Services

PRIMA Consulting Services

-

Business Operation Plan Composition

Business Operation Plan Composition

-

Setting up legal entities

With a global network of experts in their respective tax and regulatory environments, Grant Thornton advisors help individuals and corporations establish the type of business entity that will best position them to achieve their goals from the very start of their operations.

-

Liquidation and de-registration

Sometimes a business suffers an adverse event which impacts its ability to continue trading. And sometimes a solvent sale proves unsuccessful or a turnaround just isn't an option.

-

Update company statutory record

With a global network of experts in their respective tax and regulatory environments, Grant Thornton advisors help individuals and corporations establish the type of business entity that will best position them to achieve their goals from the very start of their operations.

-

Merger and Acquisition

Merger and Acquisition

-

Administrative remedies

Administrative remedies

-

Corporate legal consulting

Corporate legal consulting

-

Bankruptcy and restructuring

Bankruptcy and restructuring

-

Company dissolutions and liquidations

Company dissolutions and liquidations

-

Supplier and employee background investigations

Supplier and employee background investigations

-

Legal attest letter drafting service

Legal attest letter drafting service

-

Preparation and review of agreements in Chinese and English

Preparation and review of agreements in Chinese and English

-

Lifting restrictions on going abroad

Lifting restrictions on going abroad

-

Labor law compliance and labor-management negotiation

Labor law compliance and labor-management negotiation

-

Business and personal asset planning

Inheritance, inheritance tax, family business, and personal asset planning

-

Not for profit organizations

Not for profit organizations

-

Schools

Schools

-

Others

Others

Business leaders renew appeal for clarity on 'acceptable' tax planning

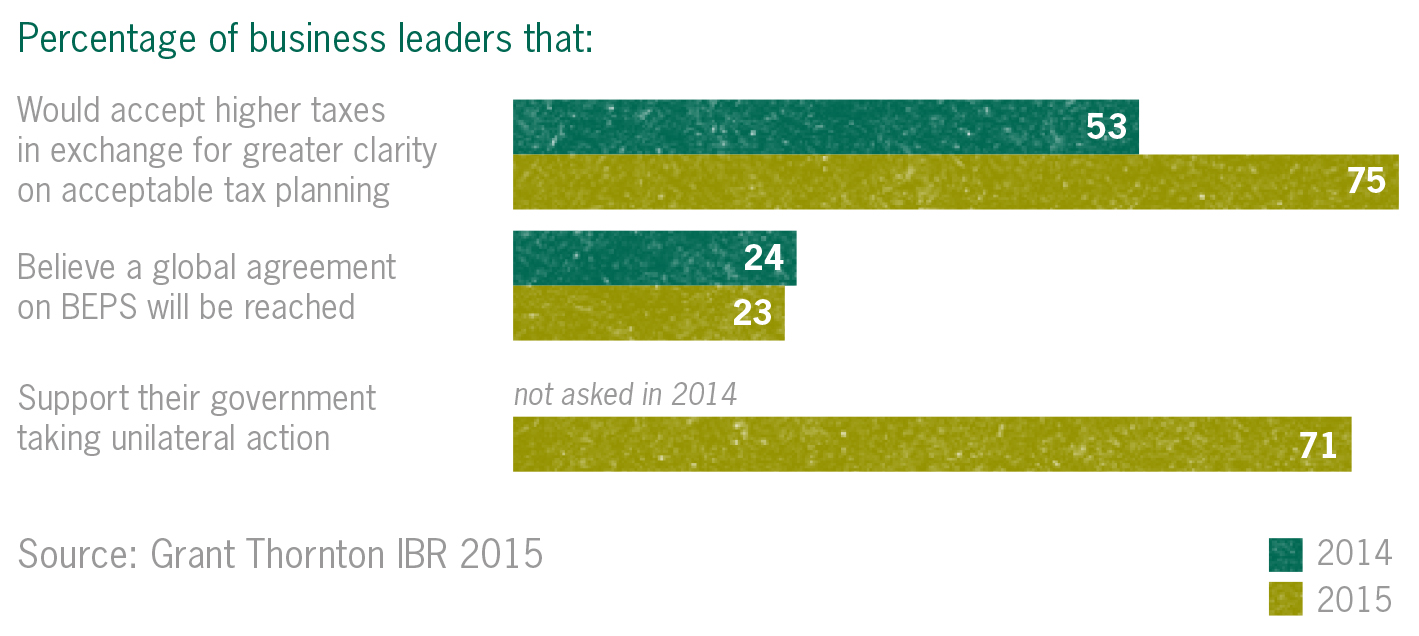

Three quarters of business leaders would pay more taxes in exchange for greater clarity from authorities on what is acceptable, according to the Grant Thornton International Business Report (IBR), a global survey of 2,580 businesses in 35 economies. And while few expect a global agreement any time soon, the majority would like to see their governments take unilateral action to help achieve this aim.

Francesca Lagerberg, global leader for tax services at Grant Thornton said: “The levels of taxation paid by businesses has become a very public and emotive issue. But setting emotion to one side, businesses have a responsibility to their investors and shareholders to keep costs down - within the existing regulatory parameters."

"Despite this, our IBR survey clearly shows that the vast majority would actually support paying more in tax in exchange for clearer guidance from tax authorities on what is acceptable tax planning. The ball is very firmly in their court to provide the clear lines that businesses are requesting. The results provide more evidence that clarity is needed in the complex world of cross border tax transactions."

When asked if they would welcome more global co-operation and guidance from tax authorities on what is acceptable and unacceptable tax planning, even if this provided less opportunity to reduce tax liabilities across borders, 75% of business leaders said 'Yes', up from 53% one year earlier.

In the G7, 75% want greater clarity, up from 43% one year earlier. Notable countries were India (95%), South Africa (94%, up from 64%) the UK (83% up from 59%) and US (83%, up from 37%).

Unilateral vs multilateral

Business leaders are not hopeful that a global agreement will be enacted to provide clearer tax rules for all. Just 23% of the survey respondents thought that the OECD's plans on global tax improvement under the Base Erosion and Profit Shifting project (BEPS) would be successfully implemented. This is slightly down from 24% one year earlier.

However, they are far more supportive of unilateral, individual country, action in lieu of a global agreement: 71% said they would support their own government taking unilateral action to combat the loss of tax revenue in their jurisdiction. Support for local action is strongest in India (95%), the US (82%), UK (79%), China (67%) and Ireland (64%).

Francesca Lagerberg continued: "Businesses may be pessimistic on the chances of a global agreement - the Doha Round and climate change negotiations have taught us that these things take time. However, the work being undertaken by the OECD on tax planning should go some way to allaying business concerns by moving this debate away from talk to action. The OECD is set to finalise its recommendations this year.

"International tax standards clearly need to be stripped down and rebuilt for the world we live in today. The existing legislation is creaking at the seams in an increasingly interconnected, digital world in which the definition of a 'border' is looking archaic. The research is showing that businesses are asking for more help to enable them to navigate the new challenges of a digital economy.”

- ends -

John Vita, Director - PR, +1-312-602-8955

Find out more about the IBR survey and explore the full data for global business optimism.