Tax

BEPS: Businesses call for clarity

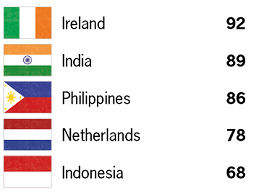

Three quarters of business leaders would pay more taxes in exchange for greater clarity from authorities on what is acceptable. And while few expect a global agreement any time soon, the majority would like to see their governments take unilateral action to help achieve this aim.